Bye bye, piggy banks!

13 Finance Apps That All Twentysomethings Should Download

There’s no getting around it: Adulting is hella hard. Yes, we’ve moved out, bought our first car… we’ve even grown up and stopped being such a picky eater. But even though we’re technically self-sufficient now, managing our money throughout the holiday season is still difficult. That’s why we’ve curated 13 finance apps that will actually make you (yes, you!) want to create a holiday budget.

1. Mint: This super convenient app puts all of your accounting in one place — including your credit cards, debit cards and 401K. With bill reminders, convenient savings graphs and transaction trends, Mint makes it simple and convenient to analyse your spending habits.

DL It: Free on Android and iOS

2. Albert: If you’re looking for a simple and free money management app, this option is definitively worth the download. The app automatically syncs all your financial information to one place and gives you an automatic rundown on how you’re doing on your budget.

DL It: Free on iOS

3. Prosper Daily: This app is for the girl with way too many subscriptions. With the cool ability to divide your spending by customizable categories (AKA streaming services, take-out, DIY supplies etc.) you’ll finally know just how much you actually pay for all of those beauty subscription boxes… for better for worse.

DL It: Free on Android and iOS

4. Robinhood: For twentysomthings that are a little more adventurous with their finances (we’re looking at you, ex-business students), Robinhood is an app that allows you to make free stock trades with just a few taps. Known for its convenience and cost-saving measures for small trades, it’s a great find for people who’ve watched The Wolf on Wall Street one too many times.

5. Credit Karma: Don’t worry, we’ve all been there. All twentysomethings eventually ask the question “What is a credit score and how the heck do I know mine.” In order to make life easy, Credit Karma invented this cool app which, with a few tidbits of information, gives you your credit score hassle-free.

DL It: Free on iOS

6. Taxfyle: Ah, taxes. Love ‘em or hate ‘em, it’s a mandatory part of growing up. Thankfully, this cool app is pretty much the Uber of finding a certified professional accountant (you can even chat with them about your specific tax questions right inside the app!). Goodbye tax stress, hello weekend shenanigans.

DL It: Free on Android and iOS

7. Invoice 2go: Freelancers, contract workers and entrepreneurs need to download this handy app ASAP. Although Paypal is a great tool for creating invoices, Invoice 2go allows you to create customizable and template-based invoices in literally minutes. Plus, it has neat features like the ability to track when your clients receive your invoice and a 14 day free trial period.

8. Acorns: If you always wanted to invest but never seem to have the time, this cool app has you covered. With the amount of money you’d spend on a PSL, the app automatically invests your small change into a diversified portfolio of over 7,000 stocks and bonds.

9. Digit: As much as we love our adorable piggy banks, saving moola is a little more complex these days. Digit is an app that makes saving money for specific goals (AKA summer vacation) easy. Just connect your bank account, plug in some details and the app will check your spending activity daily to see if you can afford to put away a few dollars for a rainy day.

DL It: Free on iOS

10. Mvelopes: Everyone knows they should be using a budget… but having the motivation to actually sit down and create one is a completely different story. With Mvelopes making a budget is as simple as a few taps. No more excuses!

DL It: Free on Android and iOS

11. Penny: Penny is a personal finance bot that explains your spending habits and income to you like only true friend can. If you can look past the fact that she is *cough* not real, she’ll become your financial bestie in no time… plus, a cool modern tool to make the most out of your bank account.

DL It: Free on Android and iOS

12. PocketGuard: Organize all of your accounting in one easy place. PocketGuard categorizes and organizes your expenses, monthly bills and subscriptions by no-nonsense tabs and graphs.

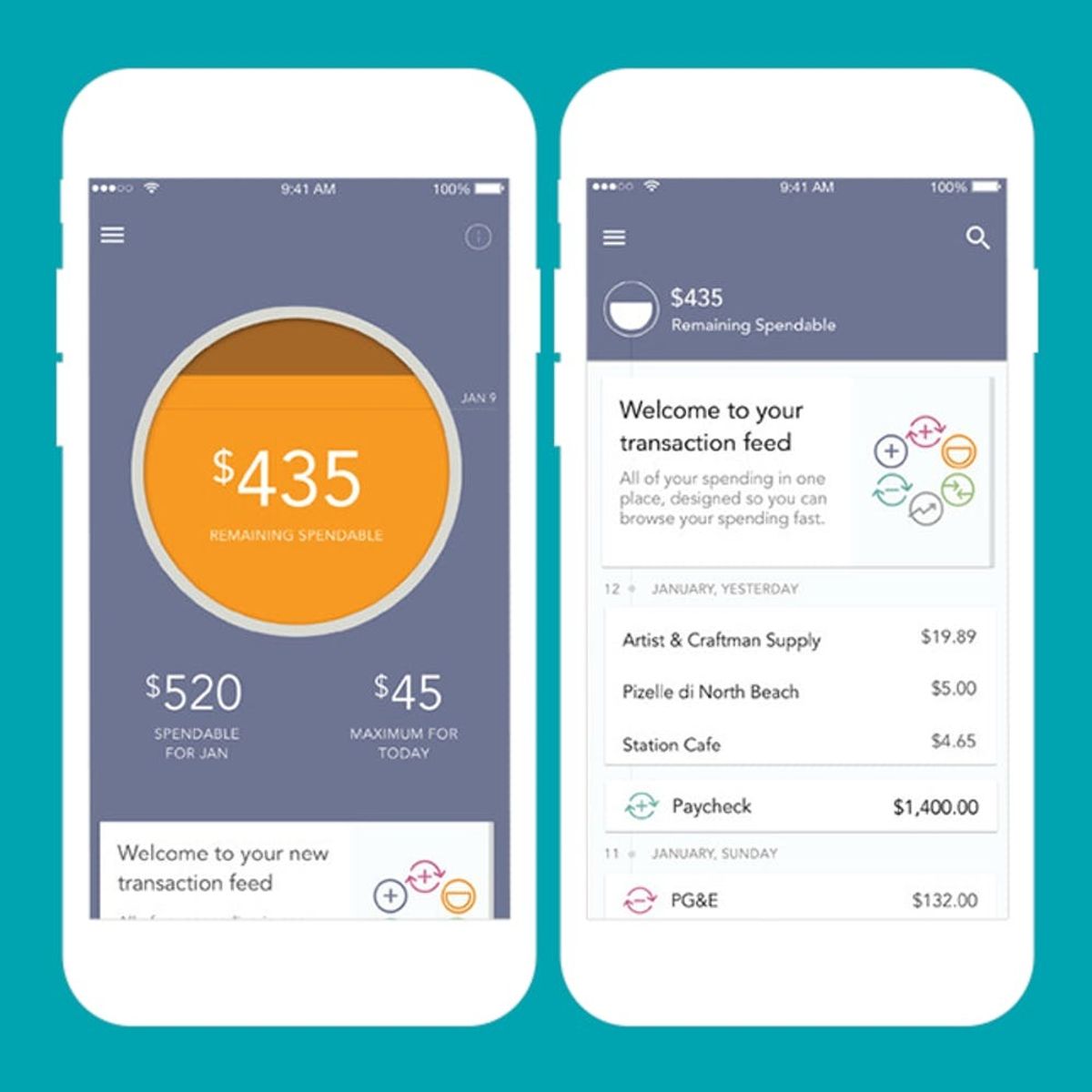

13. Level Money: Powered by Capital One, this neat app’s strength is its simplicity. After plugging in your info, you’ll be taken to a page that features a simple circle of your monthly and daily spendable income. Every time you make a purchase the circle fills itself in, so it is easy to know just how much you can spend to stay on track.

DL It: Free on Android and iOS

Do you use any money saving apps? Tweet us by mentioning @BritandCo.