To splurge or not to splurge…

This Is How Much of Your Paycheck You Should Actually Be Saving

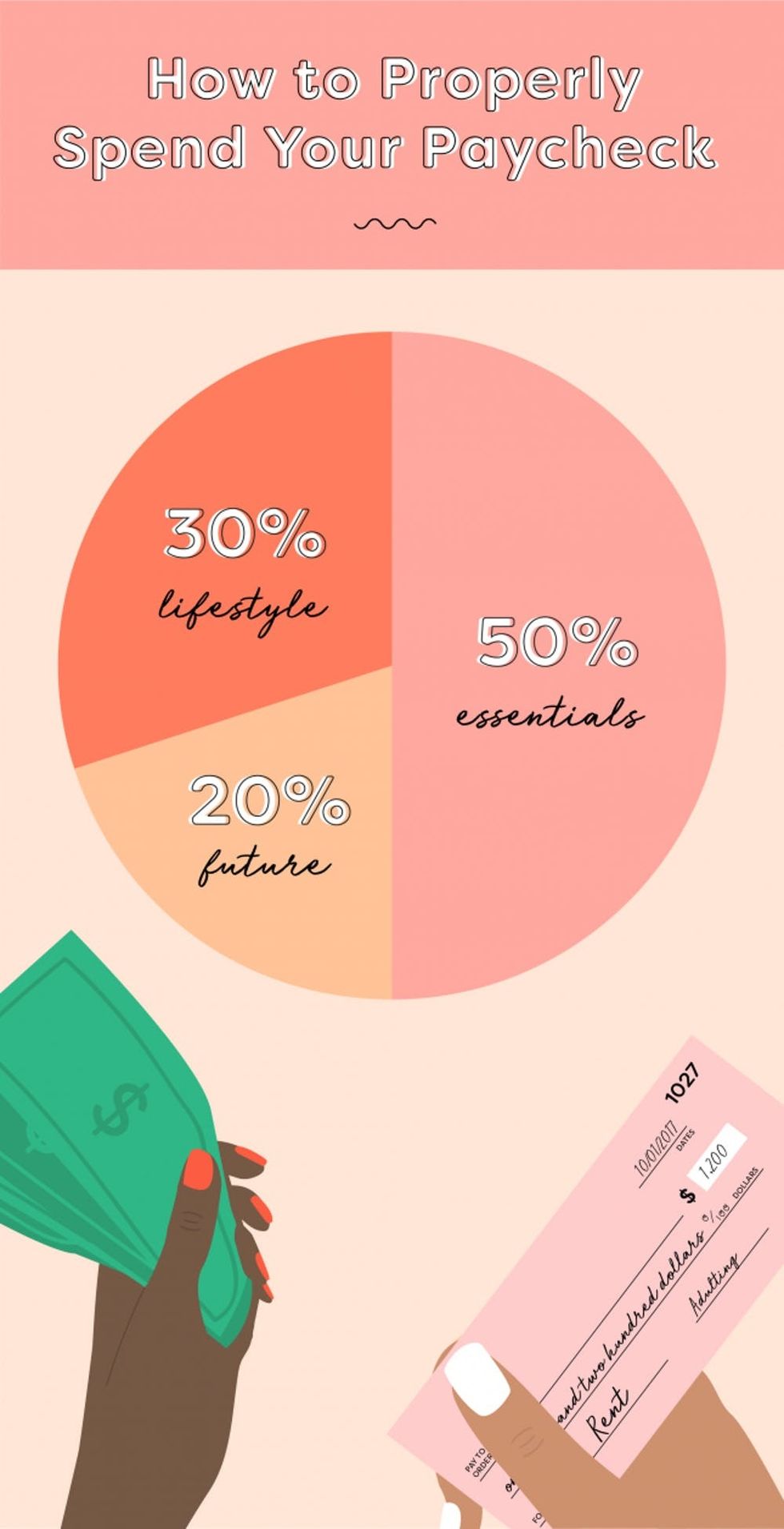

After a long two weeks of slaying the #girlboss game, you finally get the sweet notification that your paycheck has been direct-deposited into your account. But even though we would all love to blow our paycheck on an adorable pair of luxe fall booties, we’ve decided to put our adulting pants on and create a practical monthly budget we can actually stick to. To help us figure out how much of our paycheck we can spend on cute fall accessories, how much we should actually be paying for rent, and everything in between, we sat down with certified financial planner and LearnVest Founder & CEO Alexa von Tobel to learn more about how to budget effectively using the popular “50/20/30” rule.

The 50/20/30 Rule for Budgeting

If you’re anything like us, you’ve probably been putting off creating a monthly budget for quite a while — especially if you’re in the black. But even if you manage to tuck away a little extra moola every month for things like impromptu vacations, window shopping mishaps, and emergency mechanic visits, becoming financially responsible means sitting down and making a plan for how you’re going to divvy up your paycheck.

Enter the 50/20/30 rule — one of the most popular methods of budgeting in the biz. “50/20/30 represents the percentages of your take-home income that should go into three main categories: essentials, future, and lifestyle expenses,” explains von Tobel. “Fifty percent of your income should go toward essentials. Twenty percent should go to the future — like paying off debt, building an emergency fund, or saving for retirement. Thirty percent is to spend however you like.”

Let’s break this down a little further.

50 percent: What exactly counts as an essential in our budget? According to von Tobel, the 50 percent of your budget that’s reserved for essentials should be used to cover things like rent or mortgage payments, transportation to and from work, groceries (not luxury restaurants!), and utilities.

20 percent: The 20 percent of your paycheck that’s allocated for saving for your future should go toward things like emergency savings, retirement, debt repayment, and saving for a home.

30 percent: Finally, the 30 percent that you should be spending on your lifestyle is anything that is nonessential to survival, but rather something that you choose to spend your money on — this includes eating out, shopping, entertainment, and personal care. This category also includes all of your holiday shopping and expenses.

An Example: How Queenie the Marketing Guru Spends Her Paycheck

In order to better understand how the 50/20/30 budgeting rule works, we asked von Tobel to run us through a hypothetical example of how “marketing #girlboss Queenie” could use this budgeting tool to best manage her expenses. While we didn’t go through the nitty-gritty details of Queenie’s everyday spending habits, von Tobel gives us a fantastic general overview of how our exemplar par excellence can use this budgeting tool to alter her current expenses and rock her financial goals.

Queenie makes $1,900 of net income every two weeks at her awesome new marketing job. She pays $1,600 in rent every month (including utilities). She’s still working to pay off federal student loan for her undergraduate degree and also has accrued a tiny amount of credit card debt from a recent Amazon Prime haul (under $500). While she hasn’t saved a lot for retirement and emergencies, she would like to start. When she’s not working, she loves hanging out with her friends at trendy foodie spots and splurging on the latest Apple tech.

Alexa von Tobel: Queenie’s monthly take-home pay is [about] $3,800. If we break that down by the 50/20/30 rule, she should be allocating $1,900 to her essentials, $760 to the future, and $1,140 to her lifestyle choices.

Essentials (50 percent of total budget): Given that her rent is $1,600/month, that leaves only $300 for other essentials, like transportation to and from work and groceries. So my first question for Queenie would be whether lowering her monthly rent might be possible. If she lives alone, could she consider bringing in a roommate to supplement the rent? If she already lives with a roommate, could she consider moving to a more affordable apartment?

Future (20 percent of total budget): When it comes to Queenie’s credit card debt and student loans, it is important to remember that there’s a difference between good and bad debt. Bad debt is debt you’ve taken on that is not an investment in your future (AKA credit cards and car loans). Bad debt, in particular, is designed to grow quickly. It snowballs. Which is exactly why I would recommend that Queenie prioritize paying down her credit card debt as quickly as possible.

While good debt is an investment in your future that can up your earning power (student loans, for instance), that debt can still be a cause of stress for a lot of people. So, while my recommendation will always be to pay down credit card debt first, it’s important to understand that your student loan debt cannot be neglected.

It’s great to hear that Queenie would like to start saving more for retirement and emergencies! When it comes to contributing to retirement savings, that is non-negotiable in my mind. We generally estimate that you will need to replace at least 70 percent of your current income to stay above water in retirement. Compounding interest isn’t magic, it’s math — so the sooner you start, the better off you’ll be! And in terms of an emergency fund, I always recommend having at least six to nine months of your take-home pay saved.

Lifestyle (30 percent of total budget): While the 50/20/30 rule says that Queenie can spend $1,140 for her lifestyle choices (eating out with friends, buying the latest Apple tech, etc.), it may be helpful for her to consider lowering that amount for a few months and attributing more money to her future while she works on paying down debt, upping her retirement savings, and building up an emergency savings fund.

How to Make the 50/20/30 Rule Work for You

“50/20/30 is a guiding principle that works for most budgets — but money isn’t one-size-fits-all,” notes von Tobel. “So, before you dive in, recognize that your personal budget may need some wiggle room at times. For example, if you’re playing catch-up with your retirement savings, your 20 may expand. Or if you’re stuck in a lease for an expensive home, your 50 may not be there yet. The goal here is for you to understand what goes into each of these budget categories — your essentials, your future, and your lifestyle — and to understand what a balanced budget should look like.”

Now that you’ve got the basics down, grab yourself a warm fall beverage this weekend and spend an evening categorizing each of your expenses as essential, future, or lifestyle. Even if your budget doesn’t perfectly fit into the 50/20/30 mold right now, figuring out where you’re at and where you want to be will help you ask the big questions and get your finances on track for a fiscally cozy future.

Would you consider using the 50/20/30 budgeting method? Tweet us by mentioning @BritandCo.

(Photos via Getty, Illustration via Torii Burnett)