Go ahead and shop guilt-free.

8 Free Apps That Will Make Saving So Much Money Easier

When you set financial New Year's resolutions, it can be hard to stay motivated to stick to them, especially when the year starts out like this one. But while we all know progress in the bank account can impact every area of our lives, it's not always tangible in real time. Luckily, there are many apps out there to help you with this. Here are eight that stand out to us because they get you thinking out of the box to leave you feeling more financially confident.

Mercari

Did you ever consider that the key to reaching your $$$ goals this year is in your closet? Mercari makes it easy to turn old clothes into cold, hard cash. The marketplace app is online-only — which eliminates any need for face-to-face selling — and takes a 10 percent commission (less than competitors), so you walk away with more money in your pocket. Bonus: Mercari helps facilitate the shipping of your items, which is a major win among app retailers.

Did you ever consider that the key to reaching your $$$ goals this year is in your closet? Mercari makes it easy to turn old clothes into cold, hard cash. The marketplace app is online-only — which eliminates any need for face-to-face selling — and takes a 10 percent commission (less than competitors), so you walk away with more money in your pocket. Bonus: Mercari helps facilitate the shipping of your items, which is a major win among app retailers.

YNAB

The theory behind this one is short, simple, and described explicitly in the platform’s full name: You Need a Budget. Don’t we all, though? With YNAB, all deposits are categorized dollar by dollar as soon as they come into your account. Thus, minimizing the risk that you might “accidentally” take the $100 you need to pay the cable bill and spend it on a great pair of jeans. YNAB holds you accountable to a plan so that you’re not in a state of constant calculation with your financial goals. Thank goodness for that!

The theory behind this one is short, simple, and described explicitly in the platform’s full name: You Need a Budget. Don’t we all, though? With YNAB, all deposits are categorized dollar by dollar as soon as they come into your account. Thus, minimizing the risk that you might “accidentally” take the $100 you need to pay the cable bill and spend it on a great pair of jeans. YNAB holds you accountable to a plan so that you’re not in a state of constant calculation with your financial goals. Thank goodness for that!

RetailMeNot

Even a girl on a budget loves to shop, but there are always ways to shop smarter. RetailMeNot is one of these solutions. The platform collects thousands of digital coupons and promotions and corrals them into one handy spot, so you can scan for savings on items you need (or want) before you hit the stores.

Even a girl on a budget loves to shop, but there are always ways to shop smarter. RetailMeNot is one of these solutions. The platform collects thousands of digital coupons and promotions and corrals them into one handy spot, so you can scan for savings on items you need (or want) before you hit the stores.

Joy

We don’t talk enough about the emotional side of money. Like it or not, you have feelings about how much you’re spending and saving. Rather than pretending that’s not the case, Joy puts your money to good use by giving you a chance to categorize your purchases as “happy spends” and “sad spends.” The app also offers a money coach (assigned based on the results of an in-app assessment) and a free FDIC-insured savings account to ensure you’re well on track to being more responsible about your money decisions.

We don’t talk enough about the emotional side of money. Like it or not, you have feelings about how much you’re spending and saving. Rather than pretending that’s not the case, Joy puts your money to good use by giving you a chance to categorize your purchases as “happy spends” and “sad spends.” The app also offers a money coach (assigned based on the results of an in-app assessment) and a free FDIC-insured savings account to ensure you’re well on track to being more responsible about your money decisions.

Ibotta

The Ibotta slogan — “Life Rewarded” — was enough to convince us that this is an app we need, STAT. After all, who doesn’t want to be rewarded for life? This rebate app works by customizing cash back deals for you based on your spending habits. Major retailers like Walmart, Amazon, Blue Apron, Target, Hotels.com, Stitch Fix, Modcloth, and ASOS are already onboard, which makes it easy to get cash back (actual money, not points) on the things you’re buying, anyway.

The Ibotta slogan — “Life Rewarded” — was enough to convince us that this is an app we need, STAT. After all, who doesn’t want to be rewarded for life? This rebate app works by customizing cash back deals for you based on your spending habits. Major retailers like Walmart, Amazon, Blue Apron, Target, Hotels.com, Stitch Fix, Modcloth, and ASOS are already onboard, which makes it easy to get cash back (actual money, not points) on the things you’re buying, anyway.

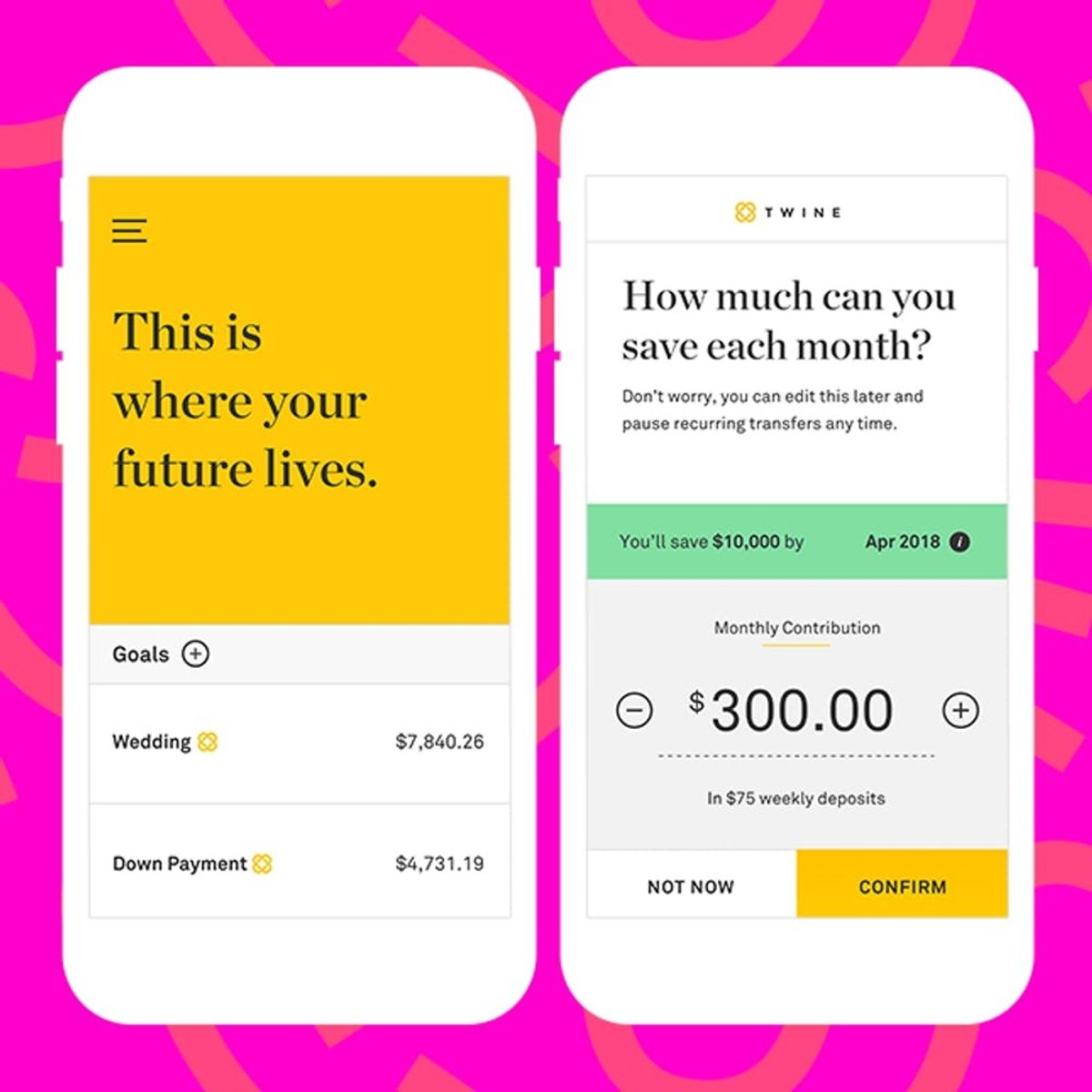

Twine

Twine is an ideal option if you and your S.O. are working toward financial goals together in the new year. Within the platform, you and your partner can set up a joint profile where you link your goal accounts and set up automatic transfers. Additionally, it gives you the chance to invest in simple portfolios based on your specific goals. Since it has bank-level security, you can feel totally safe using it too.

Twine is an ideal option if you and your S.O. are working toward financial goals together in the new year. Within the platform, you and your partner can set up a joint profile where you link your goal accounts and set up automatic transfers. Additionally, it gives you the chance to invest in simple portfolios based on your specific goals. Since it has bank-level security, you can feel totally safe using it too.

SavingStar

Grocery shopping is simply part of adulting, but thanks to SavingStar, it can also be part of your savings strategy. The app allows you to earn cash back when you shop at your local supermarket — without carrying coupons or furiously scrolling through your phone at the checkout. SavingStar offers are redeemed directly through the store’s loyalty program or via a snapshot of your receipt on the app. Once you’ve redeemed those offers, you can cash out (or buy a Starbucks gift card). Pretty great, right?

Grocery shopping is simply part of adulting, but thanks to SavingStar, it can also be part of your savings strategy. The app allows you to earn cash back when you shop at your local supermarket — without carrying coupons or furiously scrolling through your phone at the checkout. SavingStar offers are redeemed directly through the store’s loyalty program or via a snapshot of your receipt on the app. Once you’ve redeemed those offers, you can cash out (or buy a Starbucks gift card). Pretty great, right?

Honey

The Honey browser extension scans all of the coupon codes that the internet has to offer to bring relevant price promotions to you right in the knick of time (re: checkout). It also allows you to track prices and will notify you when prices drop, so you can buy items when they're at their most affordable. There's also a free rewards program, where you get a percentage back when you shop. Across Honey's six million users last year, more than $325 million was saved. Score!