You got this, girl!

How to Save Money Like an #Adult

As you make the challenging, yet exciting transition into adulthood, there are some things you will need to come to terms with. Y’all, life is a marathon, not a sprint. Although you may think you need that new pair of designer shoes, what you really need is an IRA. Saving money may seem like a daunting task, but it’s a skill that you are going to need to learn. With the help of my Brit + Co Planner, I came up with a system to track my spending habits and see the $$$ signs in my savings account grow. To read all about my successes, failures, and tips, scroll on!

KEEP UP TO DATE WITH BILLS + PAY DAYS

As a lifelong list maker, writing things down has always been instrumental in helping me remember important information. The month section of my planner is the perfect place to keep track of pay days and when bills are due.

Everything is possible with this trusty planner in hand! With so many payments to make each month, like student loans, credit card bills, utilities, streaming service, etc, it was incredibly helpful to see them all in one place. I wrote all of my monthly expenses out in the month section. This gave me a much better grasp on my relatively fixed monthly expenses. Since most of my bills are paid automatically through online banking, this allowed me to see my upcoming hard costs for the month. Seeing them all in one place allowed me to better plan out what I could afford to do socially. I’ve definitely been shook and in a financial bind when I forgot my quarterly car insurance payment was coming up and also planned a girls trip the same week. It’s one of my less proud financial fails.

TRACK DAILY SPENDING

Savings boils down to being able to hold yourself accountable and making a sincere effort. Moving from monthly to daily tracking allowed me to really hone in and see where I was using my money.

Not surprisingly, most of my expenses were food. I am always down to take a quick break from work and go on a caffeine run with my co-workers. But what doesn’t seem like too much at the time adds up.

Going out for a cappuccino a couple times a week can easily cost $20. Being able to see my repeat financial offenses showed me what habits I needed to break to become a pro-saver.

MEAL PLAN

One of my biggest money suckers was eating out. I used the daily calendars to plan out what food I was going to bring to for work each day.

Not only did meal planning help me save money, it also made me eat healthier. It’s truly a win-win situation.

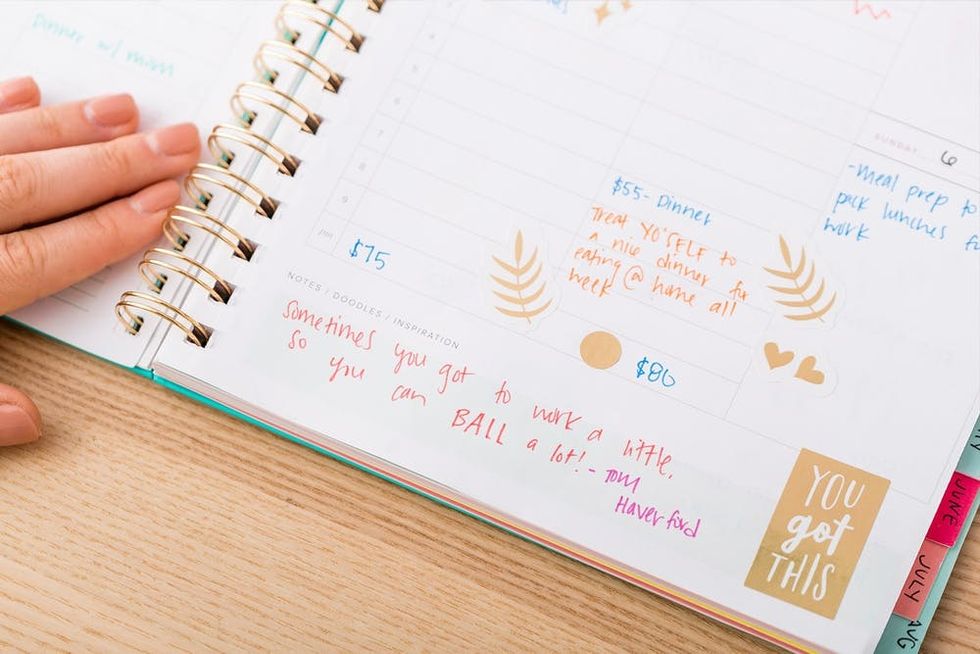

MAP OUT GOALS + REWARDS

In the notes section, I created a list of my monthly goals. Through a week of tracking my daily spending habits, I found I spent the most money on eating out, coffee shop coffee and taking taxis. For my next week, I created a reward system for myself. If I brought my lunches to work each day, I was allowed to go out to dinner on Friday night.

My overall takeaway is saving money can be hard, but my planner really helped me embark on this journey to financial responsibility. You got this girl!

Will you be picking up any Brit + Co Planners during your next Target run? Let us know on Twitter at @britandco AND share your fave items using the hashtag #BritxTarget across your social media channels!

Author and Photo Styling: Cassidy Miller

Photography: Chris Andre + Brittany Griffin