We know. You spent the better part of your weekend finishing up your taxes, and you're sick and tired of thinking about money earned, spent, and owed. But, what better day to turn over a new financially responsible leaf than Tax Day? And you can forget paperwork and spreadsheets – almost all of these tools […]

Tuesday’s Tech of the Week: Finance Edition

We know. You spent the better part of your weekend finishing up your taxes, and you're sick and tired of thinking about money earned, spent, and owed. But, what better day to turn over a new financially responsible leaf than Tax Day? And you can forget paperwork and spreadsheets – almost all of these tools are available on your smartphone!

: At the top of our list is

, possibly the best and most user-friendly way to manage personal finance around. Like the website, the mobile version of Mint connects securely to your bank accounts to track and categorize purchases and expenditures, making it easy for you to budget on-the-go. Plus, you can manually enter pending and cash transactions as they happen, so your accounts are always totally up-to-date.

, possibly the best and most user-friendly way to manage personal finance around. Like the website, the mobile version of Mint connects securely to your bank accounts to track and categorize purchases and expenditures, making it easy for you to budget on-the-go. Plus, you can manually enter pending and cash transactions as they happen, so your accounts are always totally up-to-date.

Balance: If you want a more bare bones approach to monitoring your cash-flow, try Balance. Functionally and visually, this app is similar to the paper checkbook register that accompanies all those boxes of checks you get every so often. The value in this is the idea that the exercise of manually entering in every expenditure will help you become more aware of where your money goes.

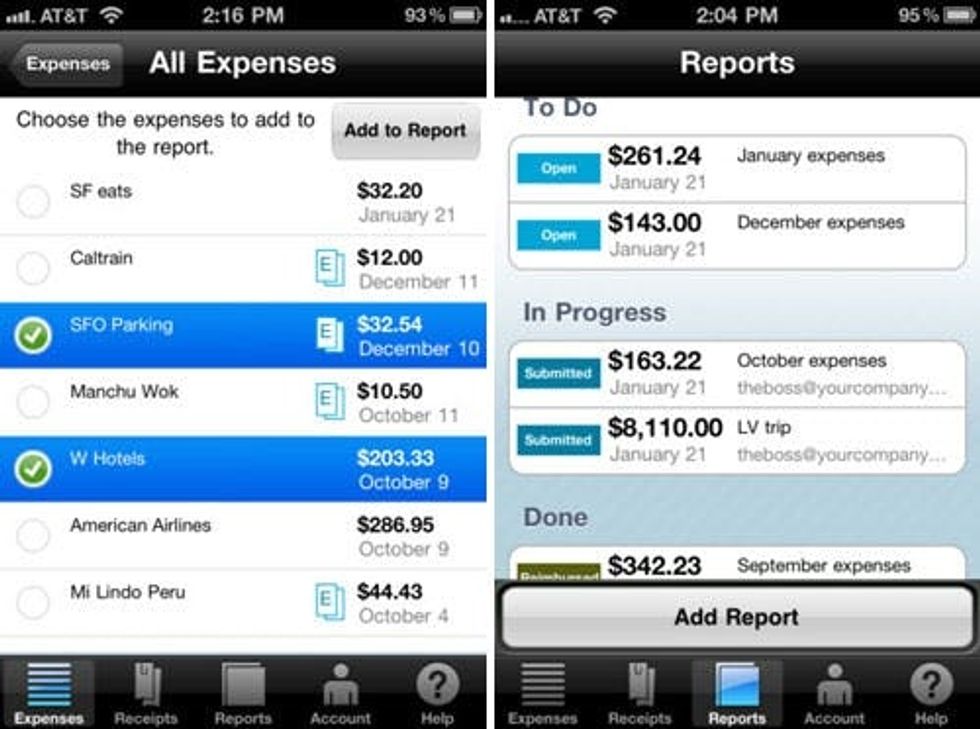

Expensify: How often have you skipped submitting an expense report simply because you were too busy? It happens to the best of us, and this app makes collecting and organizing business-related expenses so much easier! Once you set up your account and sync it with your various credit cards and bank accounts, you can easily sort all of your expenses by category. And what about all those receipts? Snap a pic on your phone, upload to Expensify, and toss that paper receipt away. Submit reports from your phone, and get reimbursed online. It's that simple.

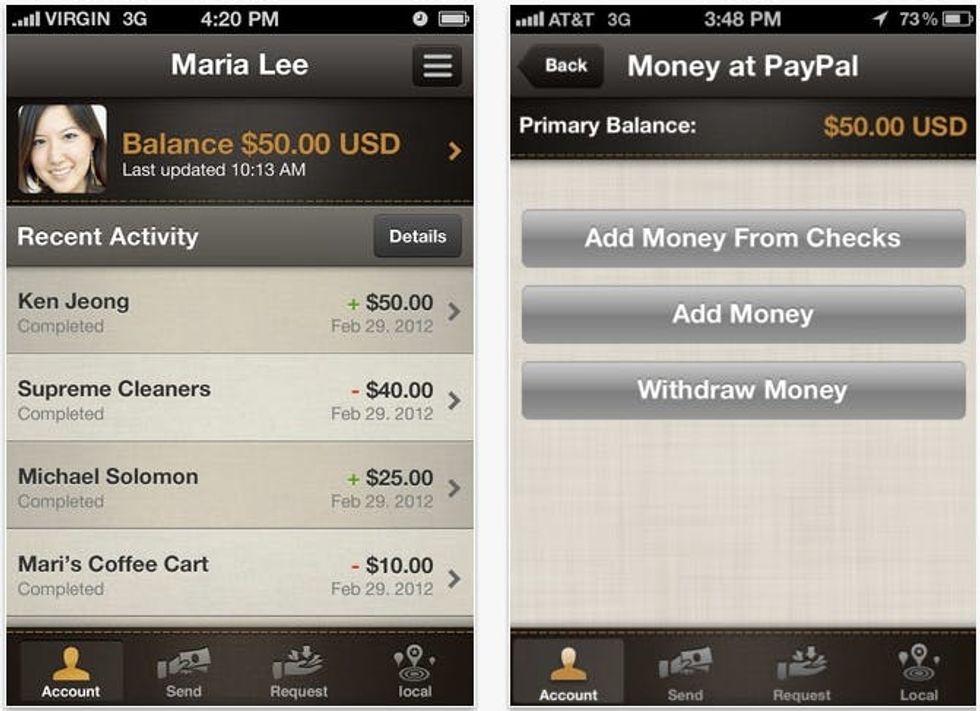

PayPal: Good old PayPal. Still one of these easiest way to send and receive money online, the mobile app makes it that much easier. Whether you're collecting funds for a group gift, receiving payments, or sending money, this app lets you do it all instantly and easily. The app even has a "split bill" feature convenient when dining out with a group.

Venmo: Like PayPal, Venmo makes is super easy to pay your friends on the move. The service is fast, convenient, and fun to use. On the app, you can keep track of all your payments and can either keep a balance in Venmo or "cash out" by linking your bank account. What sets Venmo apart is the social aspect. They invite people to leave personal notes and comments with every payment made, so you can remember all those drinks spilled, tickets purchased, and laughs had.

Square: Or perhaps you're a vendor who needs an easy way to accept credit cards no matter where you are? Boom. Square! Available on iPhone and Android, Square comes with a handy dandy card reader making credit card payments extremely simple. It links directly to your phone, where people can use the touchscreen to sign. All payments are easy to track on the app, and without a wasteful paper trail. You're charged 2.75% for every credit card swipe (no matter what card), and deposits show up in your bank account the very next day.

BillTracker: Stop forgetting those bills! With phone bills, water bills, gas bills, electric bills, gym dues, etc, it's hard to keep track of all those dates and all that money owed. BillTracker keeps all of that information in on place, and allows you to set up reminders so that your phone will alert you when a payment is coming up. You can set up recurring bills, view bill history, and make sure you never get charged a late fee again!

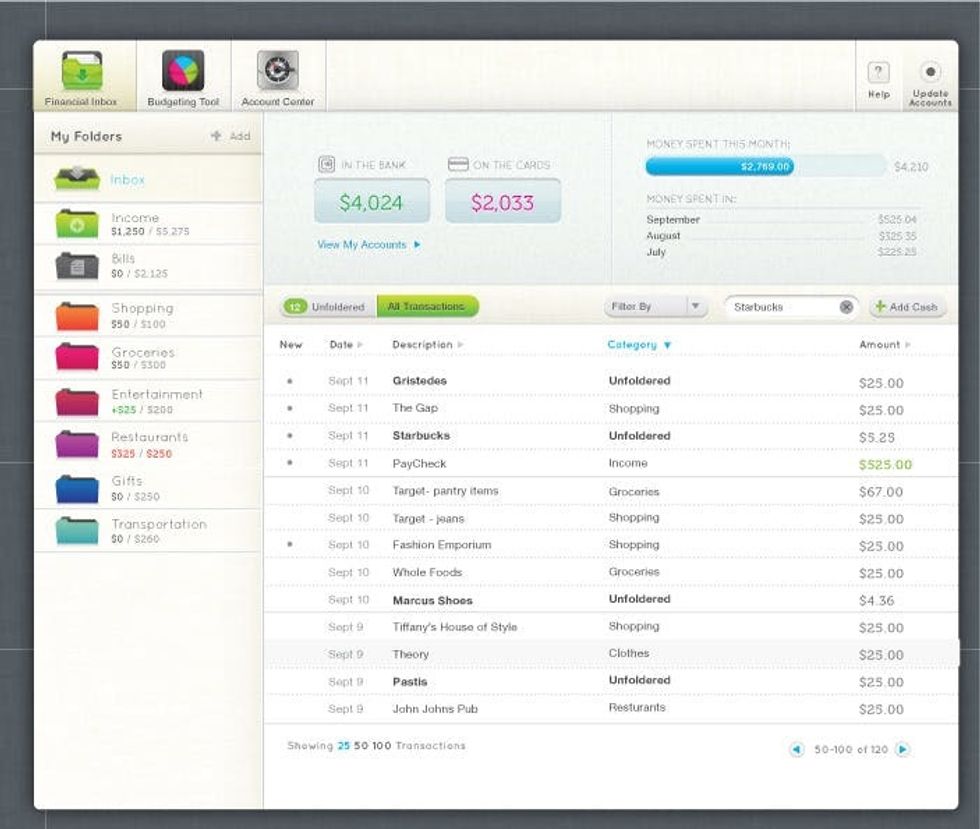

LearnVest: Not a mobile app, but an online tool for making informed financial decisions, LearnVest is sort of like Mint plus a whole lot of interesting finance-related content specifically geared towards women. They've assembled a team of experts who provide daily advice, tips, and market analysis on a daily basis. Plus, like Mint, you can view all of your accounts in one place, create a personalized budget, and track progress against your budgeting goals with ease.